9 Simple Techniques For Top 30 Forex Brokers

9 Simple Techniques For Top 30 Forex Brokers

Blog Article

All About Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers for BeginnersTop 30 Forex Brokers Things To Know Before You Get ThisThe Ultimate Guide To Top 30 Forex BrokersExamine This Report about Top 30 Forex BrokersSome Ideas on Top 30 Forex Brokers You Should KnowSome Known Details About Top 30 Forex Brokers Top 30 Forex Brokers Fundamentals Explained9 Simple Techniques For Top 30 Forex Brokers

Like various other instances in which they are utilized, bar graphes give more cost info than line graphes. Each bar graph represents eventually of trading and has the opening price, highest rate, cheapest cost, and shutting rate (OHLC) for a trade. A dash on the left represents the day's opening price, and a similar one on the right stands for the closing price.Bar graphes for currency trading assistance investors determine whether it is a buyer's or vendor's market. Japanese rice investors initially made use of candlestick charts in the 18th century. They are visually much more appealing and easier to review than the chart types defined over. The upper part of a candle light is made use of for the opening rate and greatest price factor of a money, while the reduced portion suggests the closing rate and least expensive rate point.

The smart Trick of Top 30 Forex Brokers That Nobody is Discussing

The formations and shapes in candlestick graphes are used to recognize market instructions and movement. Some of the more usual formations for candlestick graphes are hanging guy - https://dc-washington.cataloxy.us/firms/top30forexbrokers.com.htm and shooting star. Pros Largest in regards to daily trading volume on the planet Traded 24 hr a day, 5 and a fifty percent days a week Beginning capital can swiftly increase Typically adheres to the same guidelines as normal trading More decentralized than standard supply or bond markets Cons Take advantage of can make foreign exchange professions really volatile Leverage in the series of 50:1 is common Calls for an understanding of economic principles and indications Much less regulation than other markets No earnings creating tools Foreign exchange markets are the biggest in regards to daily trading volume globally and for that reason use the a lot of liquidity.

Financial institutions, brokers, and dealers in the foreign exchange markets enable a high amount of utilize, indicating investors can manage huge settings with fairly little cash. Take advantage of in the variety of 50:1 is usual in foreign exchange, though even better quantities of utilize are readily available from particular brokers. Take advantage of should be used very carefully since lots of inexperienced traders have endured substantial losses using even more take advantage of than was needed or sensible.

More About Top 30 Forex Brokers

A currency trader requires to have a big-picture understanding of the economic climates of the various countries and their interconnectedness to understand the fundamentals that drive currency values. The decentralized nature of forex markets implies it is much less regulated than other financial markets. The degree and nature of policy in forex markets rely on the trading territory.

Forex markets are among the most liquid markets in the globe. They can be less volatile than various other markets, such as genuine estate. The volatility of a specific money is a function of multiple factors, such as the politics and business economics of its nation. Events like economic instability in the form of a settlement default or imbalance in trading connections with an additional currency can result in substantial volatility.

The Basic Principles Of Top 30 Forex Brokers

The Financial Conduct Authority (http://tupalo.com/en/users/6044048) (FCA) screens and controls foreign exchange professions in the United Kingdom. Currencies with high liquidity have an all set market and display smooth and predictable cost action in feedback to outside events. The united state dollar is one of the most traded currency in the globe. It is matched up in 6 of the market's 7 most liquid money pairs.

The 45-Second Trick For Top 30 Forex Brokers

In today's information superhighway the Forex market is no longer only for the institutional capitalist. The last 10 years have actually seen an increase in non-institutional investors accessing the Forex market and the benefits it provides.

The Best Guide To Top 30 Forex Brokers

International exchange trading (foreign exchange trading) is an international market for purchasing and marketing money - FBS. 6 trillion, it is 25 times larger than all the world's supply markets. As an outcome, prices transform continuously for the currencies that Americans are most likely to use.

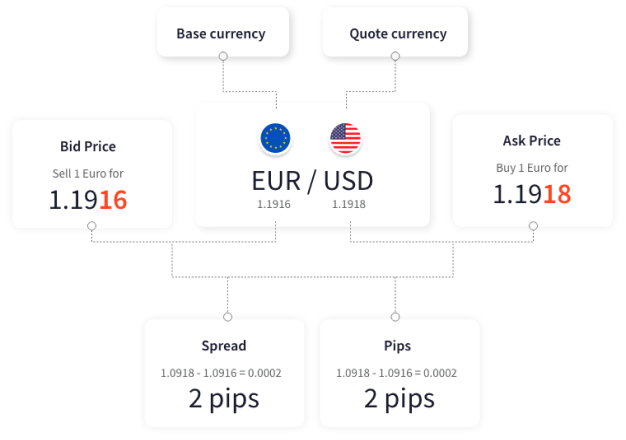

All money professions are done in pairs. When you market your currency, you receive the repayment in a various money. Every vacationer that has actually obtained foreign currency has done forex trading. When you go on vacation to Europe, you exchange dollars for euros at the going rate. You market U.S.

Little Known Questions About Top 30 Forex Brokers.

Place deals resemble exchanging currency for a journey abroad. Areas are contracts in between the investor and the market maker, or supplier. The investor purchases a particular money at the buy cost from the marketplace manufacturer and sells a click this different money at the asking price. The buy cost is somewhat more than the market price.

This is the deal cost to the investor, which consequently is the profit gained by the market maker. You paid this spread without understanding it when you exchanged your bucks for foreign money. You would see it if you made the deal, terminated your journey, and afterwards tried to trade the currency back to bucks immediately.

9 Simple Techniques For Top 30 Forex Brokers

You do this when you think the currency's value will certainly drop in the future. Companies short a money to shield themselves from risk. Shorting is extremely dangerous. If the currency climbs in value, you have to buy it from the dealership at that cost. It has the exact same advantages and disadvantages as short-selling supplies.

Report this page